Microbusiness $2,500 Grant Program

The Microbusiness COVID-19 Relief Grant (MBCRG) Program is funded through the California Office of the Small Business Advocate (CalOSBA). Sierra SBDC is administering this grant to microbusinesses in Placer, Sierra, Plumas, Lassen, and Modoc Counties at $2500 each.

QuickNav

Grant Eligibility

Grant Eligibility

You can qualify to apply if you meet these criteria:

- Located in Lassen County or Placer County*

- Been in business since December 2019

- Made less than $50,000 gross revenue in 2019

- This business is your primary source of income

- Significantly impacted by the COVID-19 pandemic

- Currently in business or plan to reopen

- Have less than 5 full-time equivalent employees

- Did not receive a CA Relief Grant through Lendistry

- *The Plumas, Sierra, and Modoc County Microbusiness applications are closed

- *The Placer County Microbusiness application is OPEN now, click “Apply” to learn more

How to Apply

How to Apply

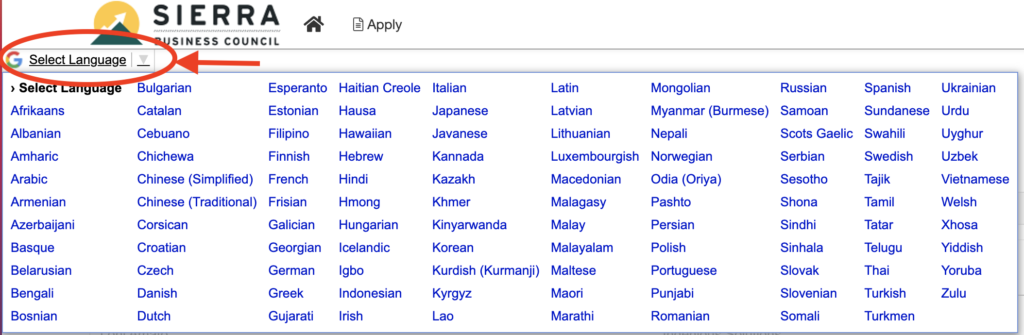

How to translate the application. Cómo traducir la solicitud.

All you need to do is fill out the application which should take 15-20 minutes. The first section is an eligibility section. If you pass that section, you will be able to fill out the rest of the application.

You will need to upload:

- Complete 2019 business tax return, OR a business license, OR a business checking bank statement, OR business financial statements from 2019

- IRS Form W-9 (available in English and en español)

- ID verification, such as a photo/scan of a driver’s license, Real ID, or passport, or other TIN identification.

If you would like assistance or have questions, please email info@sierrasbdc.com or call 530-582-5022

How Funding Will be Awarded

How Funding Will be Awarded

CalOSBA allocated a certain amount of funding per county available for grants. Grants are $2,500 each.

Applications are being accepted now for Lassen County! The application is first-come, first-serve. Applications must be complete to be considered.

Sierra County: $2,500

Plumas County: $22,500

Lassen County: $32,500

Modoc County: $10,000

The application was open on May 31st through June 30th. Plumas, Sierra, and Modoc County have no additional funds available. Sierra and Lassen Counties have additional grant funds available for eligible businesses.

Application Assistance

If you need help with your application

Call 530-582-5022 or email info@sierrasbdc.com. You may also sign up for business advising at www.sierrasbdc.com/join

FAQ

FAQs

What are the eligibility requirements of this program?

“Qualified microbusiness” means an entity that meets and self-certifies, under penalty of perjury, all of the following criteria:

- Physical address within Lassen County

- Prior to December 31, 2019, the microbusiness began its operation and was legally operating since that time, including being registered with the California Secretary of State, if required.

- The microbusiness is currently active and operating, or has a clear plan to reopen when the state permits reopening of the business.

- The microbusiness was significantly impacted by COVID-19 pandemic, as evidenced by at least a 10% reduction in revenue from the 2019 to 2020 taxable years.

- The microbusiness had less than fifty thousand dollars ($50,000) in revenues in the 2019 taxable year.

- The microbusiness currently has fewer than five full-time equivalent employees and had fewer than five full-time equivalent employees in the 2019 and 2020 taxable years.

- The microbusiness is not a business excluded from participation in the California Small Business COVID-19 Relief Grant Program, as specified in paragraph (2) of subdivision (f) of Government Code Section 12100.82.

“Qualified microbusiness owner” means an individual that meets and self-certifies, under

penalty of perjury, all of the following criteria:

- The microbusiness owner is the majority-owner and manager of the qualified microbusiness.

- The microbusiness owner’s primary means of income in the 2019 taxable year was the qualified microbusiness.

- The microbusiness owner did not receive a grant under the California Small Business COVID-19 Relief Grant Program.

- The microbusiness owner can demonstrate their eligibility as a “qualified microbusiness owner” by providing the fiscal agent with a government issued photo identification (state, domestic, or foreign), and documentation that includes the owner’s name and may include, but is not limited to, the following:

- A local business permit or license or

- A bank statement or

- A tax return or

- Additional documentation to verify a microbusiness is a “qualified microbusiness”, as deemed appropriate by the fiscal agent.

How many grants will be awarded?

Sierra County: 1

Plumas County: 9

Lassen County: 13

Modoc County: 4

What is the reasoning behind the eligible business size?

The intent of the funding from Cal OSBA is to provide relief to the hardest to reach microbusinesses and entrepreneurs. The county will implement an outreach and marketing plan to identify and engage eligible microbusinesses that face systemic barriers to access capital, including but not limited to, businesses owned by women, minorities, veterans, individuals without documentation, individuals with limited English proficiency, and business owners located in low-wealth and rural, communities.

Do I have to pay the money back, like a loan?

No. The funds you receive are a grant, not a loan, and do not need to be paid back.

Will I have to pay taxes if I receive this grant money?

The administrators cannot provide tax advice to those who receive payments. Any taxes associated with accepting or using the grant funds are the responsibility of the awardee. The administrators recommend that claimants consult with personal tax advisors for any questions regarding tax liability for these payments.

Do I have to be a U.S. citizen to apply?

No, you do not need to be a U.S. citizen to apply.

If I do not have a Tax Return, can I still apply? What other document can I upload instead?

Yes, you can apply without a tax return. If you do not have a 2019 tax return, you can upload one of the following:

- A local business permit or license

- A bank statement

- Trade Account

- 2019 Profit and Loss Statements

If you need assistance or have questions, call Sierra SBDC at 530-582-5022 or email info@sierrasbdc.com

What is a W-9 and how do I fill it out?

The administrator is required to report grant funding information to the United States Treasury at the end of the year, which is done using W-9 forms. Filling out a W-9 now will help us send out checks more quickly to successful applicants. No funds will be disbursed without a W-9 and applications will be deemed incomplete without the W-9.

Please fill out your W-9 exactly how you file your taxes for the business.

If you need assistance or have questions, call Sierra SBDC at 530-582-5022 or email info@sierrasbdc.com

Can I apply if I received funds from the Paycheck Protection Program (PPP) or Economic Injury Disaster Loan (EIDL) program?

Yes, you can apply if you received funds from the Paycheck Protection Program, EIDL or other pandemic-related loan programs.

Can I apply if I received funds from the California Relief Small Business COVID-19 Grant Program through Lendistry?

No, you may not apply if you received funds from the California Relief Grant Program.

Do I have to fill out the application online? Can I submit my application via mail or in person?

All applications must be filled out online. No physical applications will be accepted. Applications can be filled out with a mobile phone. If you need help accessing a computer with internet access or filling out the application, please contact the Sierra SBDC at 530-582-5022 or email info@sierrasbdc.com.

Do I need to submit all the documents? What if I don’t have all the documents that I need to apply?

You must submit ALL the required documents. Incomplete applications will not be considered. However, if you do not have one of the documents listed and you are a qualified business, you can have an organization sign a 3rd Party Certification Form on your behalf.

If my business receives a grant, what can I use the money for? What can’t I use the money for?

Applicants will be required to self-certify that grant funds will be used for one or more of the following eligible uses:

- The purchase of new certified equipment including, but not limited to, a cart.

- Investment in working capital.

- Application for, or renewal of, a local permit including, but not limited to, a permit to operate as a sidewalk vendor.

- Payment of business debt accrued due to the COVID-19 pandemic.

- Costs resulting from the COVID-19 pandemic and related health and safety restrictions, or business interruptions or closures incurred as a result of the COVID-19 pandemic, as defined in subdivision (l) of Section 12100.83.

If I have a home based business can I apply?

Yes, you can. You still need to provide one source of documentation that qualifies you as a business.

I own/operate more than one business. Am I allowed to submit an application for each business I own if they meet the qualifications?

No, you may only apply one time even if you own, co-own, or operate multiple businesses. Only one business will be eligible.

I have multiple locations for a single business, which address should I use?

Please select what you might consider the “primary” business location.

What if I accidentally made a mistake or entered incorrect information on my application?

You can save and edit your application until you submit it. You do not need to complete it all in one sitting. Please take your time on your application and do not submit it until you are sure it is complete and correct.

Your application will AUTOMATICALLY save once you start it. You can leave the application or close the browser at any point, and the application will be automatically saved when you return.

You can also click the “SAVE APPLICATION” button at the bottom of the form to see a summary of your in-progress application.

If I am a nonprofit can I apply?

Yes, you can apply. The general manager, CEO, executive director, or other principal at the non-profit must meet the requirements of a “Qualified microbusiness owner.” See above.

How will applications be selected to receive funding?

The application is open on a first-come, first-serve basis until funds are expended. Applications must be complete to be considered.

How will I be contacted or know if I will receive a grant?

You will be notified of your award by email. Checks will be mailed. Be sure to check your email regularly, including your spam folders. Emails to applicants will come from Micro Biz Grant Program <administrator@grantinterface.com>.

Will I be contacted if I do not receive a grant?

Yes, you will be notified by email whether or not you receive a grant.

How can I get help with my application?

If you need assistance, you can contact the Sierra SBDC, the grant administrator, at 530-582-5022, or email info@sierrasbdc.com. Se habla español.

Grant Administration

Grant Administrators

The Sierra Small Business Development Center at Sierra Business Council is administering these grant funds. This program is funded in part through a Grant from the California Office of the Small Business Advocate. All opinions, conclusions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the California Office of the Small Business Advocate.

Partner Toolkit

Partner Toolkit

3rd Party Verification Form

FLYERS / GRAPHICS

English General Flyer

Spanish General Flyer

SOCIAL MEDIA COPY

FACEBOOK / NEXTDOOR / LINKEDIN

Option 1

Application for Microbusiness grants OPEN NOW!

Eligible businesses can apply to receive a $2,500 grant from the Microbusiness COVID-19 Relief Grant Program offered through the Sierra Small Business Development Center at Sierra Business Council.

A few types of businesses who might be eligible: Artists & Musicians, Childcare Providers, Construction Workers, Food Vendors, Hair Stylists, Handy Man, House Cleaners, Gardeners & Landscapers, and Nail Technicians. Help spread the word 📢 if you or someone you know might qualify!

🗓 The application is open FIRST COME, FIRST SERVE.

Learn more and apply at www.sierrasbdc.com/microbiz-grants

Option 2

Are you a Sierra, Lassen, or Modoc County business that made less than $50,000 in 2019? You may qualify to get a $2500 COVID Relief Grant! A few types of businesses who might be eligible: Artists & Musicians, Childcare Providers, Construction Workers, Food Vendors, Hair Stylists, Handy Man, House Cleaners, Gardeners & Landscapers, and Nail Technicians. Help spread the word 📢 if you or someone you know might qualify!

🗓 The application is open FIRST COME, FIRST SERVE!

Learn more and apply at www.sierrasbdc.com/microbiz-grants

TWITTER

Microbusinesses can apply to receive a $2,500 #CovidRelief Grant! 🗓 The application is open on a first come, first serve basis. Learn more and apply at www.sierrasbdc.com/microbiz-grants #SmallBusinessGrants #Microbusiness #GrantFunding #CovidReliefGrant #SmallBusiness

EMAIL / NEWSLETTER COPY

Microbusiness Grant Application is NOW OPEN!

Microbusinesses in Sierra, Lassen, and Modoc County may be eligible for $2,500 grants! Offered by the Sierra SBDC at Sierra Business Council and funded in part by the California Office of the Small Business Advocate, the program is designed to provide relief to our community’s hardest-to-reach microbusinesses and entrepreneurs.

SBC will disburse grants of $2,500 to eligible microbusinesses impacted by the COVID-19 pandemic.

The application is open on a first-come, first-served basis until funds are expended.

To apply now, GO HERE

If you need assistance with your application, please call SBC at 530-582-5022 or email info@sierrasbdc.com.

Contact Info

Contact Info

CLICK HERE TO SIGN UP FOR ASSISTANCE AND INFO

Phone: 530-582-5022

Email: info@sierrasbdc.com